Self Employed Home Office Deduction 2025 - Self Employed Home Office Deduction 2025 Debra Eugenie, The fixed rate method for calculating your deduction for working from home. Self Employed Home Office Deduction In Powerpoint And Google Slides Cpb, The revised fixed rate method doesn’t require taxpayers to have a dedicated home office space to claim working from home expenses.

Self Employed Home Office Deduction 2025 Debra Eugenie, The fixed rate method for calculating your deduction for working from home.

Self Employed Home Office Deduction 2025. However, not all expenses are eligible for. The fixed rate method for calculating your deduction for working from home.

Self Employed Home Office Deduction 2025 Debra Eugenie, We understand that many of you will.

The Self Employed Biz Owner’s Guide to the Home Office Deduction, Home office equipment, including computers, printers and telephones.

Self Employed Home Office Deduction 2025 Debra Eugenie, However, not all expenses are eligible for.

Westerville CPA Gary Wilson Self employed Home office deduction YouTube, At the end of the financial year, you can file your tax return with the below tax deductions.

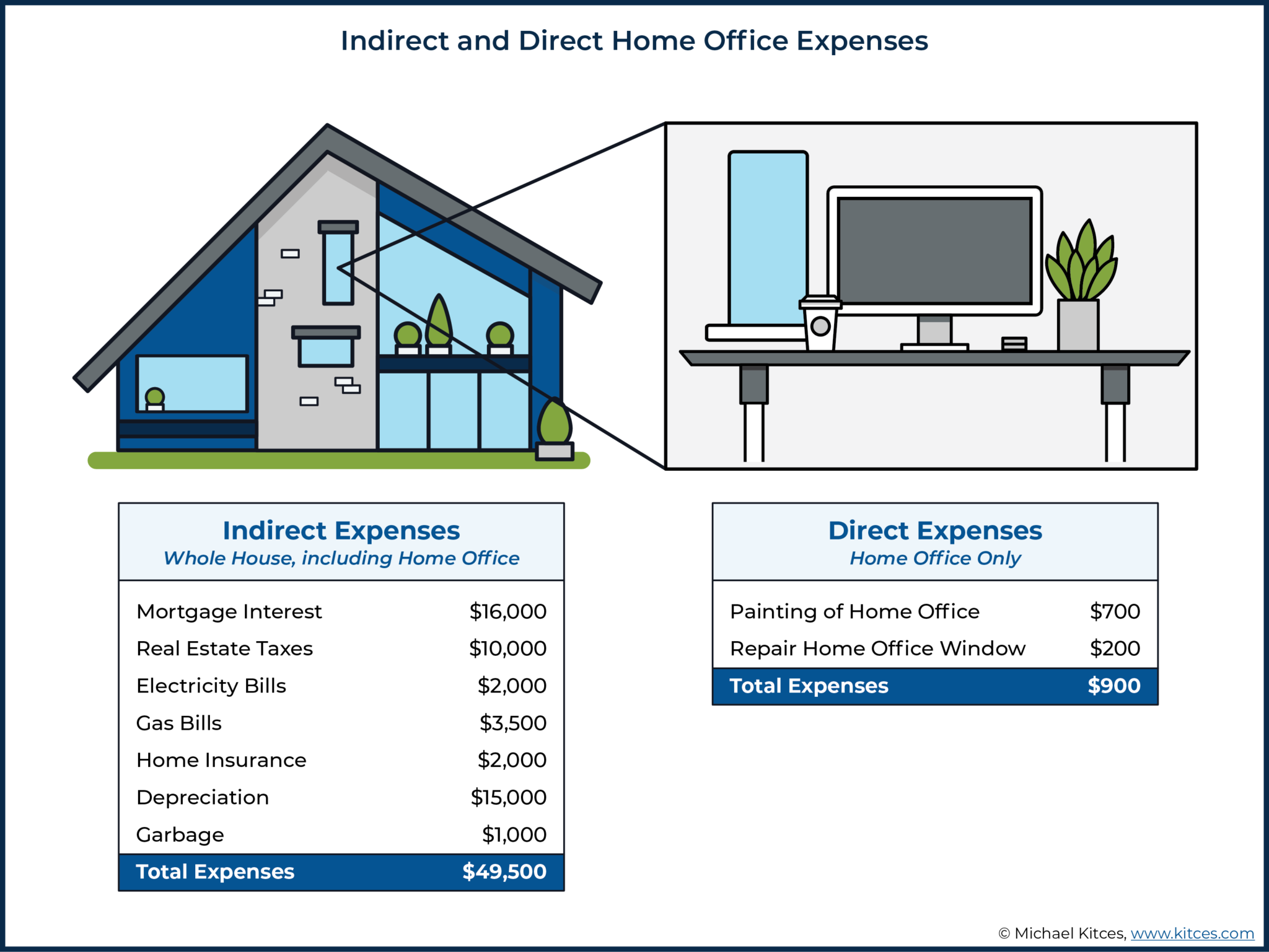

SelfEmployed Home Office Deduction [Schedule C] Simplified Option for, Home office expenses you can claim include:

How To Calculate Home Office Expenses For Tax OFFICE, How to claim occupancy and running expenses for the business use area of your home as a sole trader or partnership.

Selfemployed? You Probably Qualify for the Home Office Deduction YouTube, The fixed rate method for calculating your deduction for working from home.

If you are claiming your working from home expenses, you can’t claim a deduction for expenses which have already been reimbursed by your employer. Our calculator takes between 5 and 20 minutes to use.